If It’s 8 O’clock, It Must Be A Hard Market

By Stephen PaulinWhat to expect during this time of increasing insurance rates.

“Recently while reorganizing my home office, I was struck with nostalgia when I ran across an issue of Time magazine dated March 24, 1986. Flipping through the pages brought back memories of long-gone institutions and businesses such as: First Interstate Bank, Compaq Computers and Western Airlines, as well as existing brands like Smirnoff, Xerox and AT&T. My reason for retaining this one particular issue has less to do with offering my children a view of mid 80s commercialism, but specifically for the 10-page feature article that headlined the cover page, “Sorry, America, Your Insurance Has Been Canceled.”

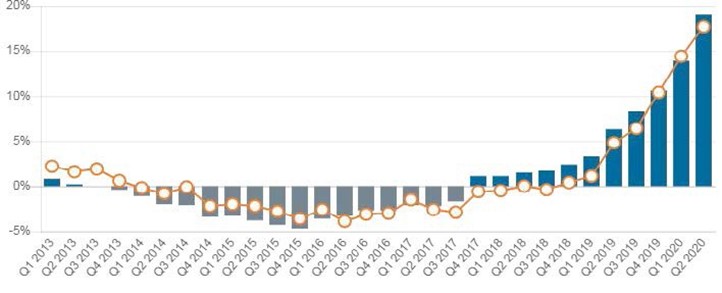

The Article details how businesses across all industries were dealing with the severe sticker shock of rapidly increasing commercial insurance rates that commonly reached as high as 300% above the expiring coverage. This was only part of the pain. Liability coverage was particularly difficult to place. Businesses were only able to secure a fraction of the excess liability previously purchased. Others had policies non-renewed with little time to place coverage elsewhere. Many companies were not able to obtain all coverages at renewal, and some went bare for a period of time. I relived my first experience with a turn from a “Soft” (buyers) to a “Hard” (sellers) market that occurred several years into my insurance career. This dramatic pricing shift occurred again in 2001-04, and then between 2010–12. While serendipitous, my magazine find comes at a time when the Property & Casualty industry has again entered another Hard Market.

March 24, 1986 Vol. 127 No. 12; Cover Artist: Guy Renee Billout

Historically, the shift from one pricing cycle to the next has been compared to a swinging pendulum. A better visual explaining how and why the insurance market shifts is the hours on a clock. Regardless of the line of insurance coverage, a set of common factors are present during each hour and affect how conditions progress to the next stage of the pricing cycle. The following synopsis illustrates conditions at each hour of the clock.

This article serves as a reminder for veteran insurance buyers and an Insurance Pricing Dynamics 101 for those who have not experienced a Hard Market.

- 1 o’clock: Insurance companies put more emphasis on gaining market share. Premiums are reduced on better classes of business. Capacity increases, more funds are available, and reinsurance is more plentiful in anticipation of profitable returns. Financial results are good across the board at this time.

- 2 o’clock: Policy pricing continues to drop to generate new business and income, and rate cutting expands to include more classes of business. As competition heats up, insurance companies cut rates more aggressively in order to retain renewals and maintain market share.

- 3 o’clock: Insurance companies look for ways to develop more new business to support their quest for additional market share through agreements with Managing General Agents (MGAs), who are given authority to rate, underwrite and issue policies, as well as adjust claims. This decentralization underwriting and authority contributes to increasing loss ratios.

- 4 o’clock: Because of the competitive conditions, the excess and surplus lines market begins to lose business. Policyholders with more hazardous exposure find rate relief in the standard market. Policy forms become broader, so insurance companies take on more risk at a lower cost. The drive for market share is in full swing as prices decrease, and the push continues to write more new business.

- 5 o’clock: the pricing for business loses all credibility as carriers accept risks at deep discounts. Underwriting fundamentals are abandoned with no accountability or criteria due to the need to expedite quotes. Pre-inspection of risks is non-existent, and loss control of current business is not enough. Loss ratios deteriorate, and some insurance companies indicate that they will “no longer play this game.”

- 6 o’clock: Prices hit bottom, and the insurance companies begin to pull back MGAs’ authority. A trend toward instilling underwriting fundamentals emerges. Insurance companies’ stocks begin to rise as the equity markets anticipate a return to profitability.

- 7 o’clock: Loss ratios are exceptionally poor, and insurance companies’ earnings are at a low. The battered reinsurance market starts to raise its rates. Capacity begins to dry up as sources of capital flee the market and search for better rates of return in other investments. Policy forms, terms and conditions are tightened as insurance companies attempt to reduce their risk of loss.

- 8 o’clock: High premium to surplus ratios and the shrinking reinsurance supply restricts carrier growth. This results in wholesale cancellation of unprofitable policyholders, and limits new policy holders to businesses that are performing better than average. This pushes rates up even higher. Buyers are unhappy.

9 o’clock: Financial results are still poor, but loss ratios start to improve as prices increase sharply. Buyers look for options to help control their costs such as large-deductible programs, captives, and self-insurance. There are indications that some insurance companies did not turn the corner soon enough, and there is fear of insolvencies within the marketplace. - 10 o’clock: Carriers move from a gain market- share mentality to an emphasis on profits, and high-risk business continues to reverse and flock back to the excess and surplus marketplace where more capacity is available. However, that capacity is still expensive.

- 11 o’clock: Insurance companies flourish and earnings multiply. The average combined ratios put carriers in a profitable position, and stock prices peak.

- 12 o’clock: High noon brings euphoria to the industry. Prices stop rising. There is a balance between the price charged and the accepted risk. New lines of insurance begin to open. Equilibrium is reached as carriers employ sound underwriting practices and appropriate loss control measures to control claims. Industry hiring expands.

Right now, Property & Casualty rates are characterized as those indicated at 8:30. Workers’ Compensation is the one exception. This coverage has experienced an unusual run of lower claim activity and profitability making this line of coverage an outlier, for the moment. This is likely to change in 2021. In California, rates

have bottomed. Profitability is eroding due to increasing Loss ratios, which are further deteriorating because of COVID-19 related claims.

In addition to the similar internal pricing factors driving rate increases in the preceding Hard Markets, today’s circumstance shares similarities where outside influences have conspired to exacerbate price increases.

For example, the industry was hard hit, paying $47B (current dollars) resulting from 9/11. This is surpassed by only $61B for Hurricane Katrina as the single largest insured loss in history.

The 2010 Hard Market was not as severe. However, significant investment losses resulting from the Great Recession, coupled with the New Zealand earthquakes and Japanese Tsunami totaling $50B was enough to move rates into the last Hard Market cycle.

Every insurer is reporting lower 2nd Quarter 2020 earnings compared to last year, with most incurring losses. In many cases the poor financial performance is attributed to COVID-19 related claims. While it is too early to tell the depth of the Pandemic’s affect, this is likely to extend the current pricing cycle we are experiencing.

Business owners are wise to assess what the future may hold, and how the additional expense will affect operations. The cost of commodities, changing credit market, COVID-19 and evolving consumer demands all impact tactics, strategies, planning and goals to maximize profit. Similarly, understanding at what point the insurance cycle exists on the clock, whether it is trending toward a hard or soft market, and the velocity of change can impact decisions about the structure and type of insurance program, as well the amount of coverage the budget will allow.

For many organizations, this is the time to consider Alternative Risk Transfer (ART) arrangements, such as Loss Sensitive Programs – Retrospective Rating, Large Deductible and Captive Insurance as ways to gain more control of its Total Cost of Risk. These perform particularly well for Automobile, Liability and Workers’ Compensation. With Workers’ Compensation likely to enter its own Hard Market in 2021, developing a level of understanding about these options now, will help prepare for and mitigate this eventual difficulty.

In the meantime, it is important to remain vigilant in managing risk and your insurance program. Actively communicating with your agent or broker is imperative. It is during challenging times like this where talent carries the day. At Orion Risk Management, we are drawing from our extensive Hard Market experiences and ART expertise to proactively work with our clients to help them through these challenging market conditions. We will partner with you to identify your exposures and create a tailored solution that minimizes the potential negative financial impact to your organization.

Steve Paulin, CIC is a Risk Management professional and Workers’ Compensation Practice Leader for Orion Risk Management, an Alera Group company. Steve has over 35 years of experience helping mid-market businesses reach their profit goals by optimizing the insurance program’s financial efficiency and risk management outcomes. Steve has extensive experience with Loss Sensitive programs, including Large Deductible and forming Captive programs.

The Alera Group is an insurance and financial services firm assisting clients around the country from over 100 locations and with more than 2,500 team members. We are professional collaborators – learning from each other, challenging each other and supporting each other to deliver results to our clients. Individually, we are all very capable, but we shine and deliver the best solutions when we work together.

Latest News

Improving Risk Management Drives Better Business Performance

October 27, 2023Managing the hard insurance market: Time for an alternative approach

October 26, 2023Managing Risk to Increase Profit: The CFO as Chief Risk Officer

October 26, 2023