Managing the hard insurance market: Time for an alternative approach

By Stephen Paulin

As insurers continue to raise rates, toughen requirements, and limit coverage and capacity, innovative business leaders are looking beyond the traditional insurance marketplace to alternative solutions. Buyers are fatigued from five years of rate increases, being victims of insurance cycles and want more predictability and greater control over insurance expenses. For a growing number of mid-market companies, captives are an answer. Captive premium growth has trended upward over the past five years. In 2022, North America-based captives grew by 15%.

Captives can be a viable solution

A captive enables a business to become an insurance owner rather than a buyer. For Commercial Casualty insurance, Workers’ Compensation, captives dominate formations at approximately 50% followed by General Liability and Fleet Auto.

In a captive’s partial self-insured arrangement, the insured forms, owns, and controls their own insurance company. Captives offer a wide range of potential benefits, including:

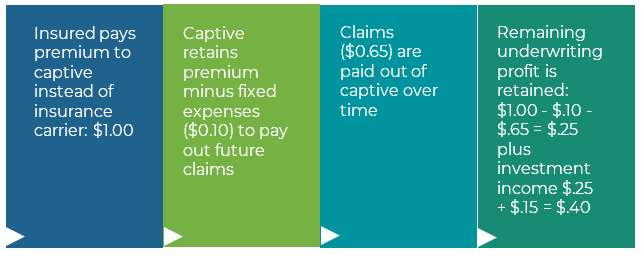

- Savings – When you purchase coverage from an insurance carrier, the price you pay includes their acquisition costs, overhead and administration expenses and profit. A captive doesn’t eliminate all the expenses, but it does reduce them. Savings in a captive can be up to 40% and average 20-25%.

- Pricing stability – Traditional insurers set prices based on a broad range of businesses, industry segment experience and general market conditions – not your specific situation. In a captive, your pricing is based on your business. If your loss history is stable from year to year, your pricing will be as well.

- Tailored protection – The captive has the freedom to design coverage for exclusions or perils that are not readily obtainable in the traditional insurance market or are considered too expensive. Examples include Business Interruption Coverage for Virus/Communicable disease, Cyber Risk, and Construction Defect.

- Control over claims management – The captive has direct control over how claims are managed.

- An additional revenue source – Captive owners benefit from increased cash flow, underwriting profit and investment income.

- Improved risk control – Captive owners have a strong financial incentive to reduce risk because any underwriting profits earned by the company belong to the owners.

- Improve tax strategy.Because they report profits differently from other companies, captive insurance companies have significant tax advantages.

How captives work

The business uses its capital to form its own insurance company. Key formation activities include an annual underwriting process selecting the risks they wish to insure and then having an actuary provide appropriate pricing for the coverage selected, including a defined stop-loss. Typically, a captive manager is engaged to assist with these activities and in the management of the captive, making sure that it stays in compliance and that administrative functions are being completed. Should a covered claim occur, the captive would reimburse the operating entity just as it would from a traditional insurer. Underwiring profits at the end of the policy’s term belong to the captive owner(s).

Types of captives

There are many variations on how a captive can be structured. This enables organizations to tailor the approach based on their individual situations. Captive types include:

Single Parent Captive – These captives are formed up by a single owner to insure its own risks and the risks of its subsidiaries. There are two types, 831(a) and 831(b). The latter, known as a “micro-captive,” is the fastest growing type in the middle-market.

Group Captive – Group captives are owned by multiple non-related organizations. There are two types, homogeneous, insuring business in the same industry, or Heterogenous having diverse operations. A Group Captive can be a good option when you want to reduce start-up costs and/or your current insurance premiums are not large enough to support a Single Parent Captive. Remember that this option requires participants to pool risks and claims experience with other owners.

Rent-a-Captive – An arrangement in which a captive insurer “rents” its facilities to an outside organization, thereby providing the benefits that captives offer without the financial commitments that captives require.

Protected Cell Companies (PCCs) – PCCs allow captives to segregate accounts so that each account is legally protected from the liabilities of other accounts within the captive. PCCs can be used in conjunction with Rent-a-Captives to help protect participants.

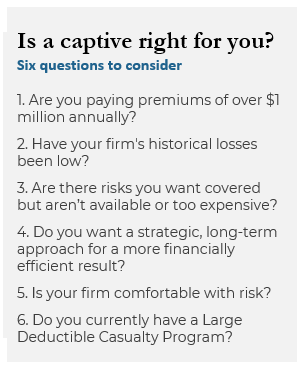

Evaluating whether a captive makes sense

Captives aren’t for everyone. Organizations that can benefit from captives are typically $75 million plus in revenues and pay substantial insurance premiums for General Liability, Commercial Auto or Workers’ compensation insurance. The ability to purchase the coverages and limits needed at an affordable price is also a major consideration.

Captives deliver the best results for organizations that:

- Want greater control

- Are profitable

- Have good loss experience

- Can assume greater administrative responsibility

- Are committed to understanding, managing and reducing risk

Deciding whether a captive is right for you depends on multiple factors, including a cost-benefit analysis. A broker with experience in alternative risk transfer mechanisms can help you assess your options and determine what makes financial sense for your organization.

Stephen Paulin

Workers Compensation Practice Leader

Captive Manager

Steve has over 35 years of experience helping businesses reach their profit goals by improving risk management outcomes that optimize the insurance program’s financial efficiency to produce better business performance. Using his strategic, long-term approach, exacting research and diagnostic process, Steve delivers measurable results to help organizations capture more profit while being safer with increased productivity.

He has extensive experience working with publicly held entities and organizations with national and international operations. He brings this expertise to his privately held clients and specializes in structuring innovative workers’ compensation large deductible placements and captive insurance formations, and holistic cyber risk programs. Orion Risk Management is the Captive Manager for clients.

Steve is a prolific writer on many insurance-related topics. He has authored and contributed his thought leadership to Business Insurance, Insurance Journal and California Workers’ Compensation Enquirer, among others. He is a Certified Insurance Counselor (CIC). A graduate of the USC Marshall School of Business, Steve continues his involvement with the university as a member of Marshall Partners, an Emeritus Member of the USC Alumni Association Board of Governors and active in the Swim With Mike Foundation. Steve is a 28-year Vistage member, serves on the Association for Corporate Growth Orange County Board of Directors, and is an active community volunteer. He is a founding member of The Lott IMPACT Foundation®, which annually presents The Ronnie Lott IMPACT Trophy to the college football defensive IMPACT player of the year. IMPACT is an acronym for Integrity, Maturity, Performance, Academics, Community, and Tenacity.

You can access additional thought pieces here, https://www.orionrisk.com/news/

You can reach Steve at: SPaulin@orionrisk.com.

Latest News

Improving Risk Management Drives Better Business Performance

October 27, 2023Managing the hard insurance market: Time for an alternative approach

October 26, 2023Managing Risk to Increase Profit: The CFO as Chief Risk Officer

October 26, 2023