Property and Casualty Insurance: Are you an investor or trader?

By Stephen Paulin

Property and Casualty Insurance: Are you an investor or trader?

When investing in stocks, real estate, or other markets, two approaches dominate: trading (short-term) and investing (long-term.) Both offer opportunities, but success depends on knowing how the game is played and not mistaking one approach for the other.

When purchasing Property and Casualty insurance, it’s equally important to know the rules of the game. The insurance marketplace matches capital with risk. Buyers and sellers of risk trade at different prices depending on factors such as policy terms, inflation, underwriting discipline, investment returns, and insurance industry profitability. Individual characteristics of the risk being insured, such as location, type of business, and loss history, play a parallel role in determining the available market. When you buy insurance, you essentially rent a portion of the insurer’s balance sheet for a specified policy term. In exchange, you receive protection to minimize the risks of running and growing your business. The insurer is committing capital to you with the goal of earning a profit.

Heavy losses and increased reinsurance costs are taking a severe toll on the Property and Casualty industry’s capital, surplus and profitability. In response, insurers continue raising rates, reducing terms and conditions, limiting capacity, and deploying rigorous underwriting standards. This trend is likely to last through 2024. While the current hard market (seller’s market) doesn’t exhibit as large a rate increases as previous ones, it will be the longest. Read the two-year market analysis.

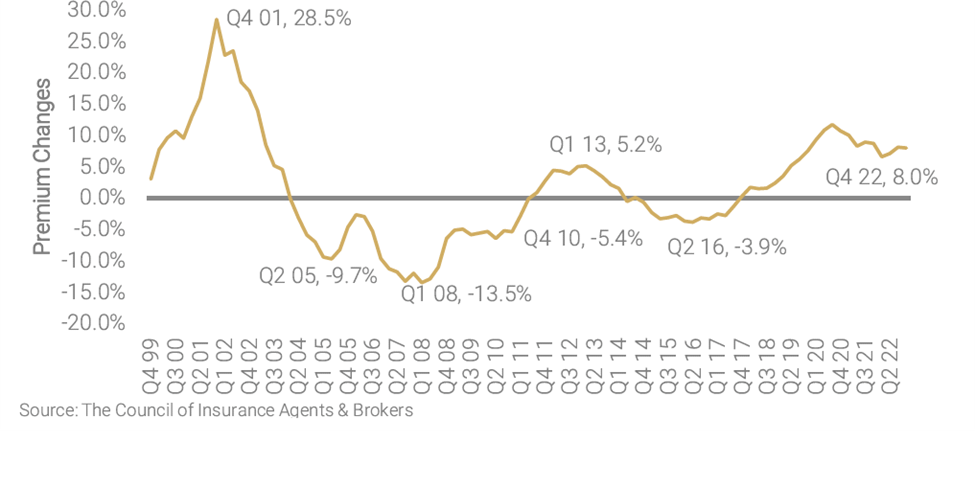

Average insurance premium changes, 1999 – Q4 2022

| Key numbers at a glance 8.0%: average premium increase across all account sizes, down slightly from 8.1% in Q3 2022 21: number of consecutive quarters of increased premiums for all account sizes 9.1%: average premium increase for large accounts, higher than both small (6.5%) and medium (8.3%) |

Navigating the environment

Under pressure to achieve profitability, underwriters will be highly selective in the accounts they insure. Pricing and coverage availability will depend on your industry, loss history, proximity to catastrophe-prone areas and your broker’s effectiveness in presenting your business in the most favorable light. To invest in you, insurers must be confident that you’re a well-managed, profitable organization committed to managing risk.

In current conditions, the quality and expertise of your broker matter more than ever. They are your voice in the marketplace. Their ability to understand, package and effectively present your organization will drive the level of interest you receive from insurers. Ensure that your broker has a defined and proven process for analyzing your business and building an in-depth narrative that will be compelling to insurers. Their process must also discover specific needs, develop tailored solutions, identify the most appropriate options in the market, and negotiate the best program based on your risk tolerance. It’s vital to anticipate and plan for possible setbacks in coverage terms, limits, deductibles, and pricing.

One of the most effective ways to navigate the market is to have an investor mindset. My experience during four hard market cycles confirms that organizations who think like investors achieve the most favorable results. Trading, or shopping coverage every year, is an outdated strategy. This short-term price-centric approach gives up control to what the marketplace ultimately dictates. When buyers adopt an investor approach, they take a longer-term view and work to build relationships that deliver mutually beneficial results for both parties over time. These strong working relationships work to the client’s advantage – especially in hard market cycles.

You can find best practices for navigating the market and market outlook information for your industry in Alera Group’s 2023 Property and Casualty Market Outlook.

Stephen Paulin

Workers Compensation Practice Leader & Cyber Risk Specialist

Steve has over 35 years of experience helping businesses reach their profit goals by improving risk management outcomes that optimize the insurance program’s financial efficiency to produce better business performance. Using his strategic, long-term approach, exacting research and diagnostic process, Steve delivers measurable results to help organizations capture more profit while being safer with increased productivity.

He has extensive experience working with publicly held entities and national and international organizations. He specializes in structuring innovative workers’ compensation large deductible placements and captive insurance formations, and holistic cyber risk programs.

Steve is a sought-after expert on insurance topics. He has authored and contributed his thought leadership to Business Insurance, Insurance Journal and California Workers’ Compensation Enquirer, among others. He is a Certified Insurance Counselor (CIC). You can reach Steve at: SPaulin@orionrisk.com.

Latest News

Improving Risk Management Drives Better Business Performance

October 27, 2023Managing the hard insurance market: Time for an alternative approach

October 26, 2023Managing Risk to Increase Profit: The CFO as Chief Risk Officer

October 26, 2023