Managing Risk to Increase Profit: The CFO as Chief Risk Officer

By Stephen Paulin

The responsibilities of the chief financial leader are broader and more diverse than ever. One of the pillars of today’s CFO’s responsibilities is risk management. In most middle-market organizations, the CFO is the first line of defense in maintaining adequate risk prevention and control and is at the epicenter for making risk/reward business decisions.

The CFOs’ involvement goes beyond the traditional areas of credit and financial risk to all areas of organizational risk, including hazard (insurable risk), operational, human capital and strategic. As the risks organizations face become increasingly complex, few CFOs have the bandwidth or in-depth expertise needed to do the job alone. In many midsized companies, management looks to insurance brokers to fill the knowledge gap.

The challenge is that the insurance industry traditionally focuses on insurance products and prices. Over the years, insurance costs have been the measure against which insurance, risk and brokers are evaluated. In my 35+ years of experience working with businesses, concentrating on price as the chief metric is a flawed strategy. It fails to address the ultimate effectiveness of the broker, the insurance and risk prevention/control program, and the bottom-line value these bring to the organization. What is truly needed is changing the perspective from a 365-day transaction to a strategic, long-term plan measuring total cost and outcomes.

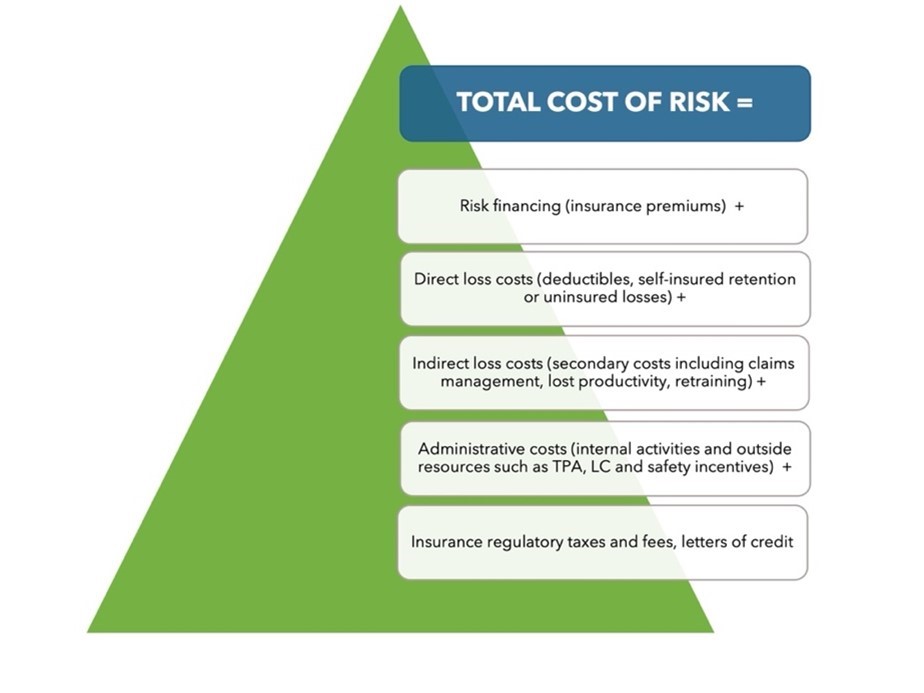

Total Cost of Risk: A better measure

While it’s important to evaluate insurance premiums, it’s crucial for CFOs to focus on Total Cost of Risk (TCOR). That’s because premiums are only one component of cost. TCOR, on the other hand, considers all the costs associated with a company’s insurance and risk management program. TCOR measures the five areas related to insurable risk. They are risk financing, direct loss costs, indirect loss costs, administrative costs, and insurance regulatory taxes, fees and letters of credit. Using a lens that looks beyond pure insurance premiums opens enormous possibilities to improve business performance and increase profitability. This can include stepping away from traditional insurance into a program where the organization accepts a greater amount of financial risk.

For example, Workers’ Compensation studies show that indirect loss costs, such as additional supervision time and administration, temporary labor and overtime often go unmeasured, but can be as much as 50% more than direct costs. Let’s say you have a workplace injury with $50,000 in direct costs and $25,000 in indirect costs resulting in a total loss of $75,000. If the business’s margin is 10%, that business would have to generate $750,000 in additional revenue to cover all the costs associated with that loss.

Over the long run, aggregated claims can be hundreds or thousands of dollars if not in the millions. Might it then be easier and more cost-effective to reduce claim frequency and severity rather than trying to generate the additional needed revenue to offset this cost?

The TCOR mindset looks beyond asset protection to deliver not just better insurance outcomes but improved business performance. This is accomplished in a larger, broad-reaching manner than previously utilized with the traditional insurance price mindset. Through TCOR, Hazard is the only one of these risks that can be quantified, thereby making it the linchpin to profit improvement. By reducing TCOR, your organization benefits by mitigating or funding your other areas of risk: Financial, Operational, Human Capital and Strategic. These are impacted by the Return on Investment from the TCOR model as outlined:

Financial Risk. Includes currency exchange, asset devaluation, accounts receivable, non-payment of contracts, or banking lines of credit. Reducing TCOR makes your company more profitable.

Operational Risks. The risk a business experiences regarding its ability to operate efficiently. Such risks include the geographic environment, maintaining or improving equipment, acquisitions, and supplier inefficiencies. Reducing TCOR allows you to do more with less.

Human Capital Risk. In good or bad economic times, a business’s most important asset is its people. This is the intellectual capital that keeps everything else going. The risk of loss includes not just the health of the worker, but their ability to contribute. Such things as layoffs or poor morale contribute to this risk. Improving employee wellness and reducing work-related injuries increases workforce productivity and contributes to the organization’s efficiency.

Strategic Risk. Relates to competitiveness. These risks include losing key customers, improper product positioning, regulatory issues or customer pricing pressure. Reducing TCOR makes your company more competitive by producing a lower relative marginal cost.

Through effective use of TCOR, organizations reduce controllable costs which can be used to increase EBITDA, capturing previously unrealized profit. These savings are amplified when organizations transition from traditional policies to alternative risk programs like large deductibles, risk retention groups and captive insurance.

Choosing a broker with TCOR capabilities

Implementing a high-impact TCOR strategy requires a broker with a strong desire to understand the inner workings of the client’s organization and the tenacity to dig beneath the surface.

Look for a broker with:

- A mindset that is consultative, diagnostic, results-oriented, and focused on managing risks rather than selling insurance.

- Deep experience in your industry. Assessing and understanding the business’ exposures to loss, within the context of your industry, provides the essential foundation for structuring a risk and insurance program that reduces TCOR. This is accomplished through access to and strong relationships with the top insurers in the client’s industry, special programs and negotiated coverages.

- A defined and proven process and documented TCOR results for similar clients.

- Claims management resources. A strong advocate can impact the outcome of a claim through case reviews, adjusting and closure. By addressing reserves, a skilled claims manager can reduce claims through innovative pre- and post-term tactics.

- Client-focused loss control services that support the organization’s loss mitigation strategy. This extends beyond the basic resources and limited perspective insurers provide.

- Specialty capabilities and resources to reduce claims and sustain improvement. These include innovative employee pre-screening practices, safety incentives, ergonomic capabilities, actuarial services, HR support, regulatory compliance, third-party administrators, and alternative risk transfer programs.

The TCOR partnership

Effective TCOR programs hinge on a strong partnership between the broker and the organization. Finding a broker who can become a trusted financial advisor is worth the effort. TCOR can deliver significant benefits, including:

- A holistic view of risk and the risk drivers that expose your organization to significant adverse outcomes.

- Insights to manage risk and reduce insurance and non-insurance-related costs across the entire business.

- Methodology for measuring the efficacy of your risk and insurance programs.

- Improved profitability by addressing controllable costs and finding easy improvement wins.

- Aid to financial planning. Understanding TCOR can help your company set the appropriate risk retention levels or determine better ways to allocate capital.

- Better outcomes in insurer negotiations. Being able to present accurate risk data builds insurers’ comfort level with your business, which can moderate rate increases.

TCOR isn’t for every business. It is a concept worth exploring when you’re ready to move beyond bidding insurance to understanding your organization’s risk/return equation and its impact on profitability. If you want to learn more, please get in touch with me at: SPaulin@orionrisk.com.

Stephen Paulin

Workers Compensation Practice Leader & Cyber Risk Specialist

Steve has over 35 years of experience helping businesses reach their profit goals by improving risk management outcomes that optimize the insurance program’s financial efficiency to produce better business performance. Using his strategic, long-term approach, exacting research and diagnostic process, Steve delivers measurable results to help organizations capture more profit while being safer with increased productivity.

He has extensive experience working with publicly held entities and organizations with national and international operations. He brings this expertise to his privately held clients and specializes in structuring innovative workers’ compensation large deductible placements and captive insurance formations, and holistic cyber risk programs.

While highly proficient in his knowledge of all business insurance policies, Steve has the distinction of honing his cyber risk expertise over the past 20 years to become highly regarded for his insight and solutions to this quickly expanding and evolving area of risk. During this time, Steve has been advising clients on implementing his holistic cybersecurity best practices and insurance protection approach. Ultimately, his clients are viewed by cyber insurers as preferred risks, thereby obtaining programs with better terms and conditions and appropriate limits of coverage at the most cost-effective premium.

Steve is a prolific writer on many insurance-related topics. He has authored and contributed his thought leadership to Business Insurance, Insurance Journal and California Workers’ Compensation Enquirer, among others. He is a Certified Insurance Counselor (CIC). A graduate of the USC Marshall School of Business, Steve continues his involvement with the university as a member of Marshall Partners, an Emeritus Member of the USC Alumni Association Board of Governors and active in the Swim With Mike Foundation. Steve is a 28-year Vistage member, serves on the Association for Corporate Growth Orange County Board of Directors, and is an active community volunteer. He is a founding member of The Lott IMPACT Foundation®, which annually presents The Ronnie Lott IMPACT Trophy to the college football defensive IMPACT player of the year. IMPACT is an acronym for Integrity, Maturity, Performance, Academics, Community, and Tenacity.

You can access additional thought pieces here, https://orionrisk.com/news/

You can reach Steve at: SPaulin@orionrisk.com.

Latest News

Improving Risk Management Drives Better Business Performance

October 27, 2023Managing the hard insurance market: Time for an alternative approach

October 26, 2023Managing Risk to Increase Profit: The CFO as Chief Risk Officer

October 26, 2023